The partnership gives Filipinos access to up to P1 million travel insurance coverage for only P199

MANILA, PHILIPPINES – Following their previous combined efforts to bridge more Filipinos to accessible and affordable insurance, Oona Insurance expands its initiatives once more with leading mobile phone provider Globe Telecom – this time to offer travel insurance through the latter’s account management platform, GlobeOne.

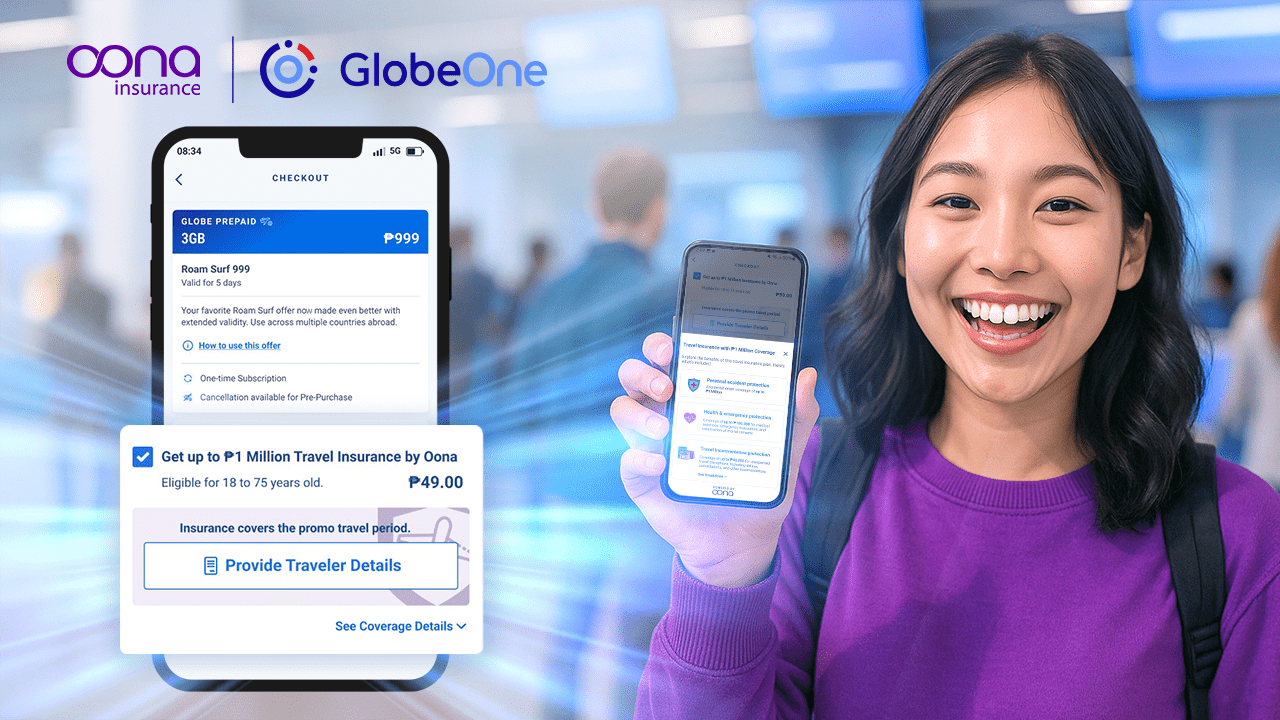

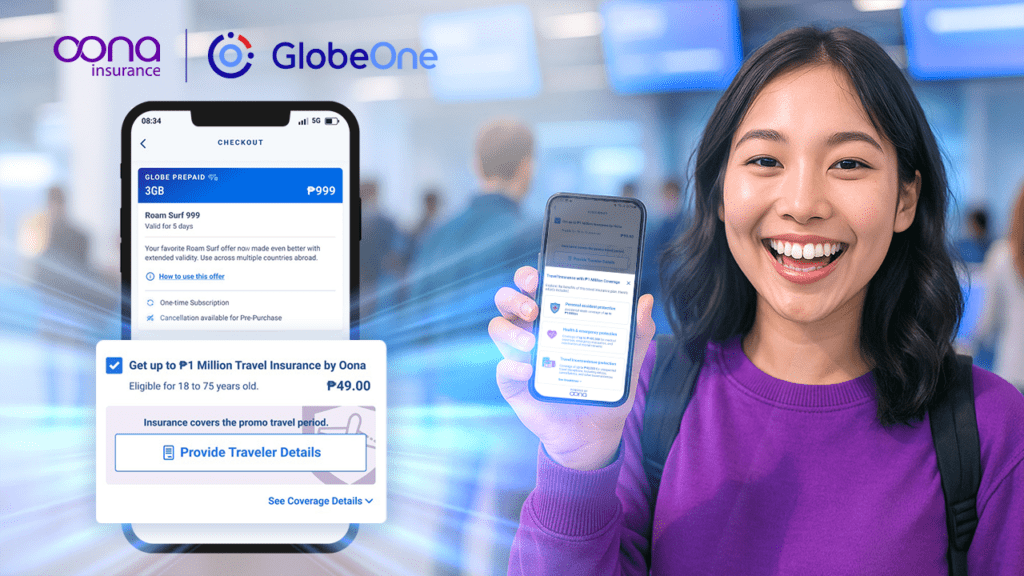

Taking the next step in their long-term partnership, Oona through the GlobeOne app has now embedded their travel protection directly into consumers’ prepaid roaming journey – adding a layer of ease and convenience in every individual’s travels.

With this added offer, customers can now purchase Oona’s Travel Insurance through the GlobeOne App, ensuring they’re protected wherever their travels take them.

How To Purchase

Eligible for individuals aged 18 to 75 years old, Oona’s travel insurance can be added upon checkout when selecting a country-specific roaming plan via the Globe One App. Simply go to the prepaid section, select your destination and preferred roaming package and select Oona’s travel insurance for just PHP 199.

With just a few clicks, customers can access up to PHP 1 million in personal accident protection, health emergency coverage of up to PHP 100,000, and travel inconvenience benefits of up to PHP 40,000.

Just as well, patrons eyeing Oona’s travel insurance through the GlobeOne app can expect not only 24/7 travel assistance anytime, anywhere in the world – but also the option to avail their desired coverage option at any point in their trip.

It’s a quick and hassle-free way to get comprehensive coverage seamlessly integrated into your travel experience with Globe and Oona.

Oona together with Globe, continue to banner its commitment to providing Filipinos smart, accessible, and worry-free protection – making every journey secure from the moment you purchase your roaming plan.

For more information, visit https://myoona.ph/all-product/travel-insurance/ for more comprehensive insurance offerings.