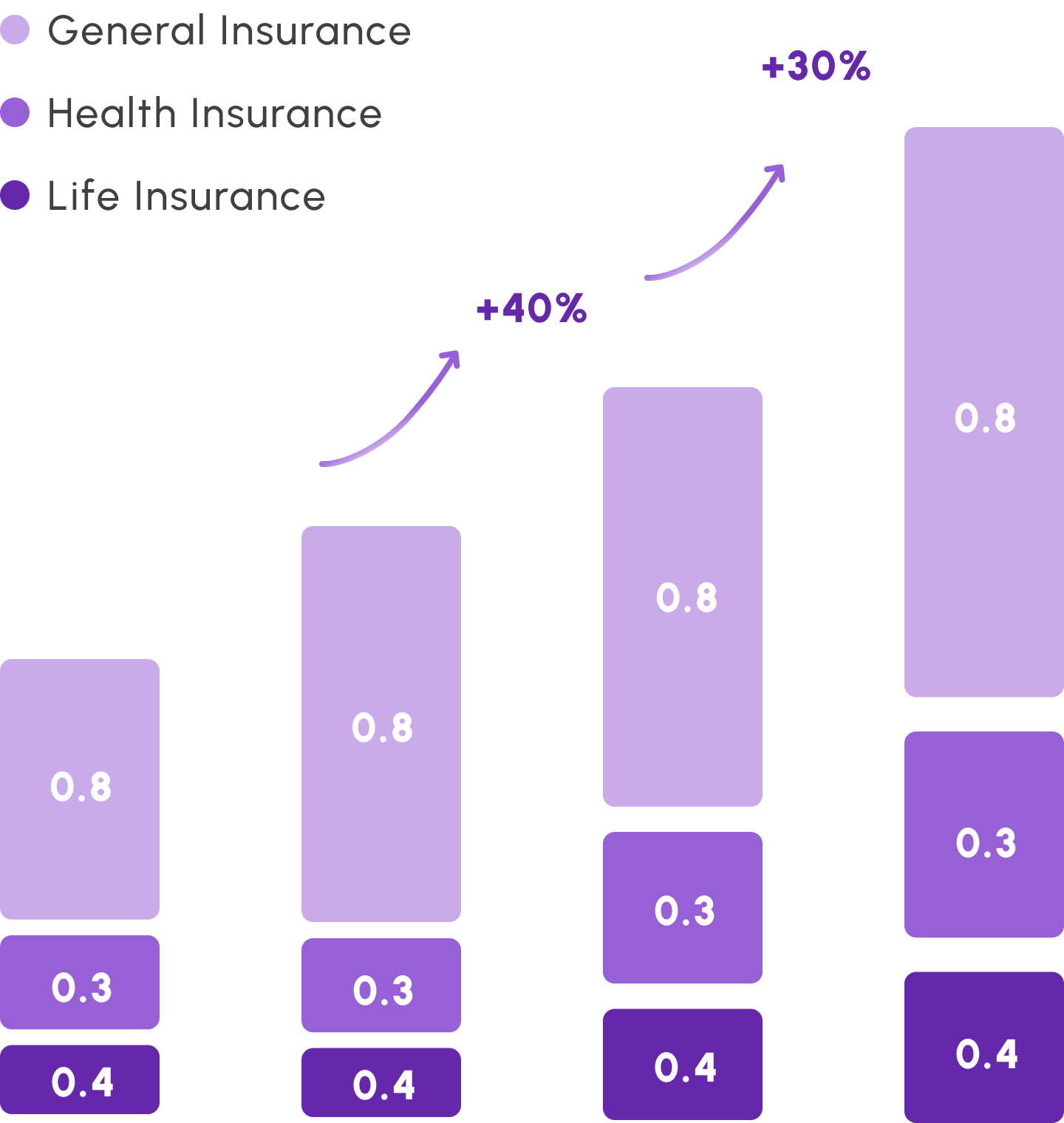

Target product portfolio

OONA will be a digitally-enabled platform with a focus on large, profitable and fast-growing lines of business.

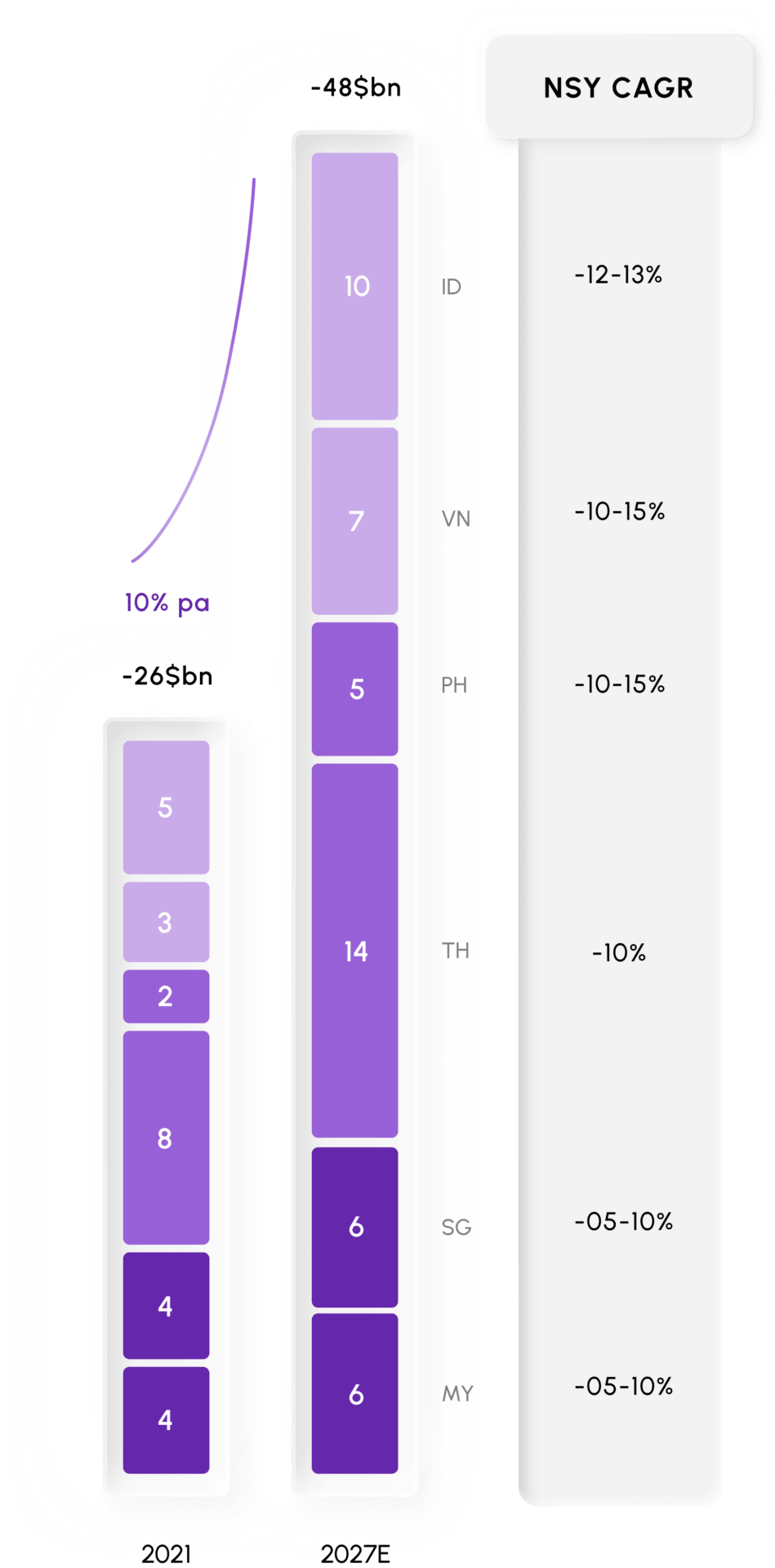

MOTOR

One of the largest lines of business to grow at ~10% CAGR going forward

~10% p.a.

HEALTH

Fast-growing line of business with ~$3bn GWPs, expected to grow at a ~15% CAGR, driven by strong COVID tailwinds.

~15% p.a

NEW AGE DIGITAL SEGMENT

SEA e-commerce GMV has grown to $120Bn in 2021, and expected to continue growing at a 18% CAGR to ~$230Bn by 2025.

~18% p.a

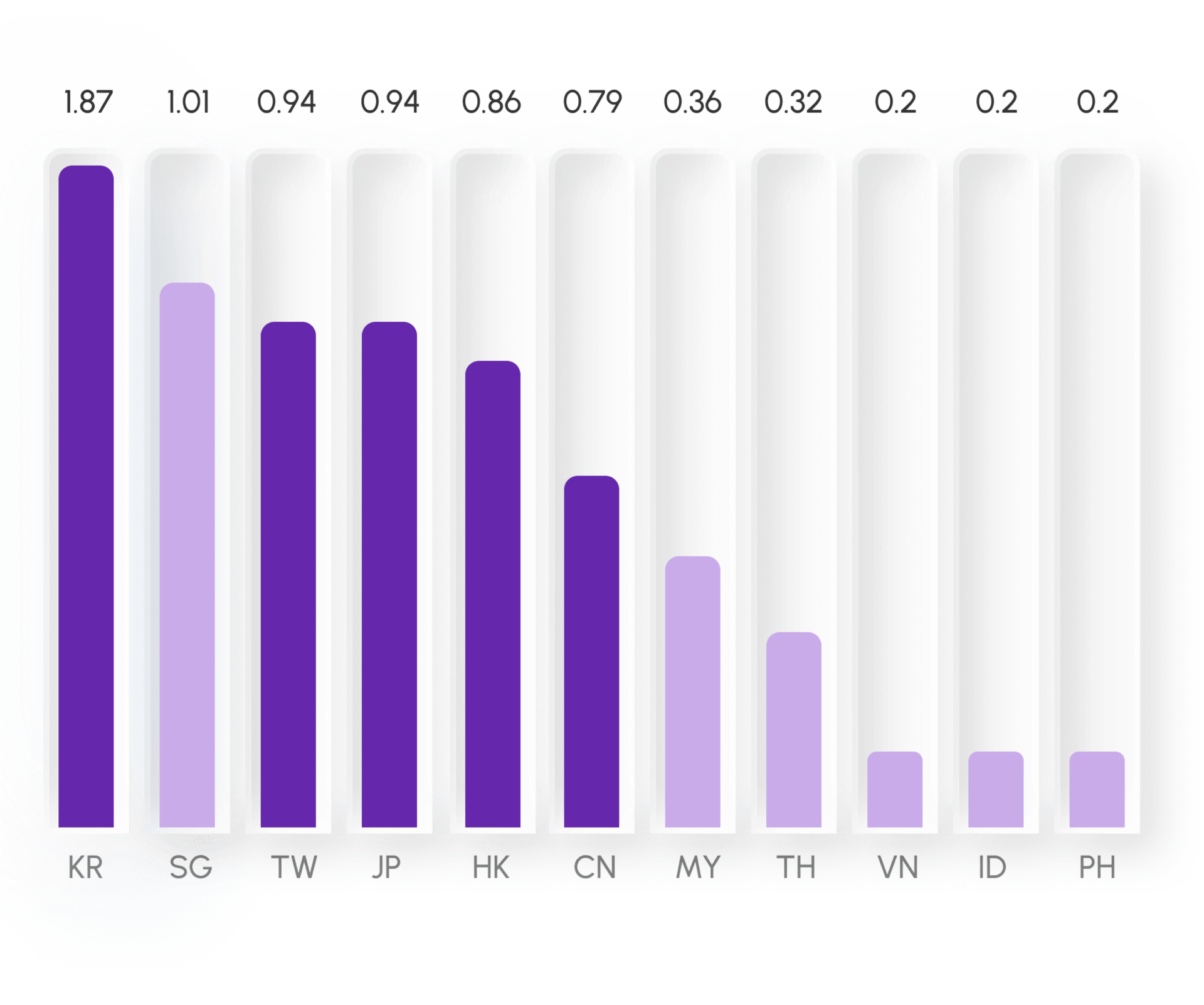

General insurance in SEA

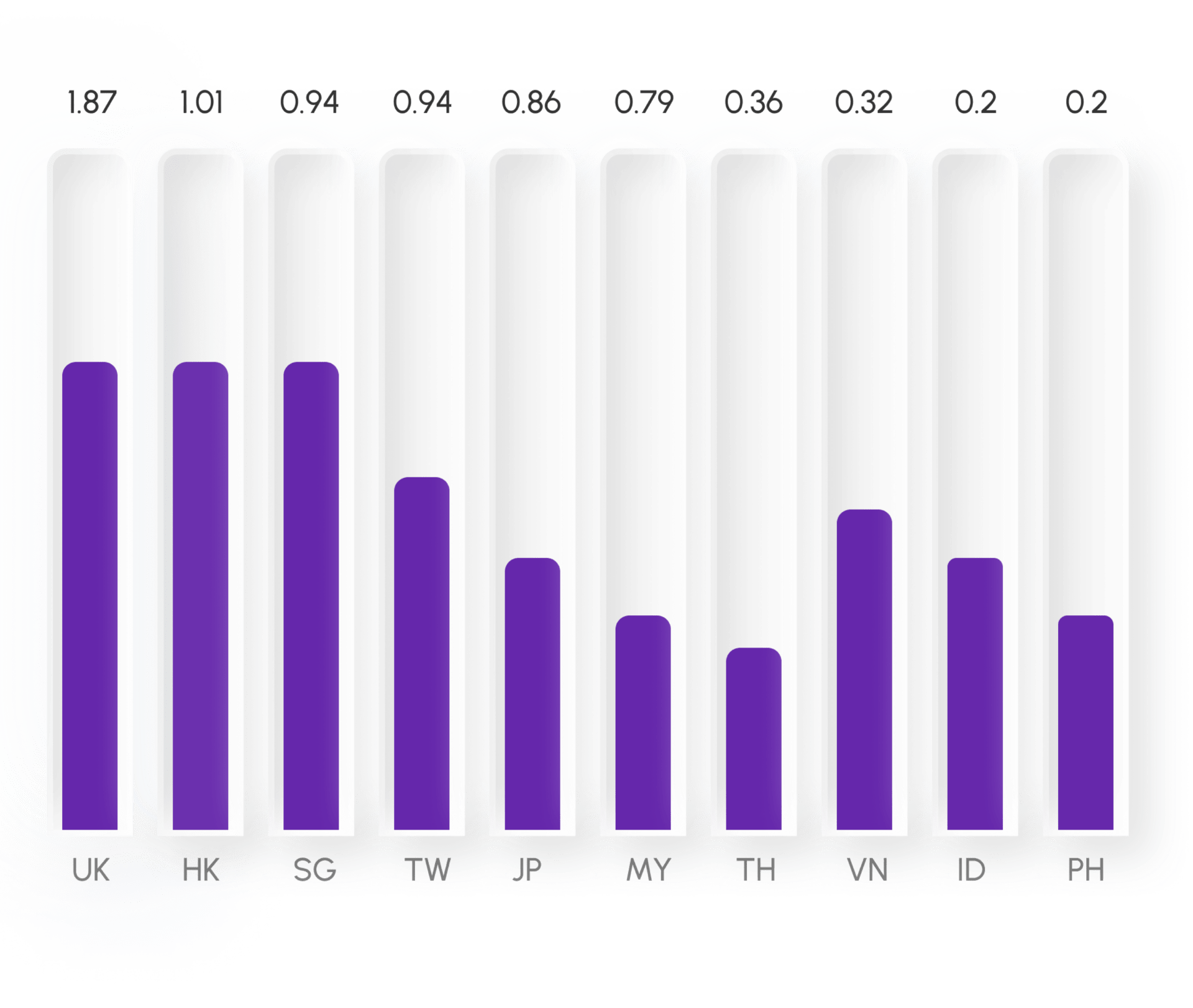

SEA – Internet Economy and Digital Financial Services Data

All SEA Economics experiencing rapid growth in terms of internet GMV

All markets are exhibiting double-digit growth, with the philippines leading by a margin.

SEA internet economies, by GMV ($B)

Indonesia

Malaysia

Philippines

Singapore

Thailand

Vietnam

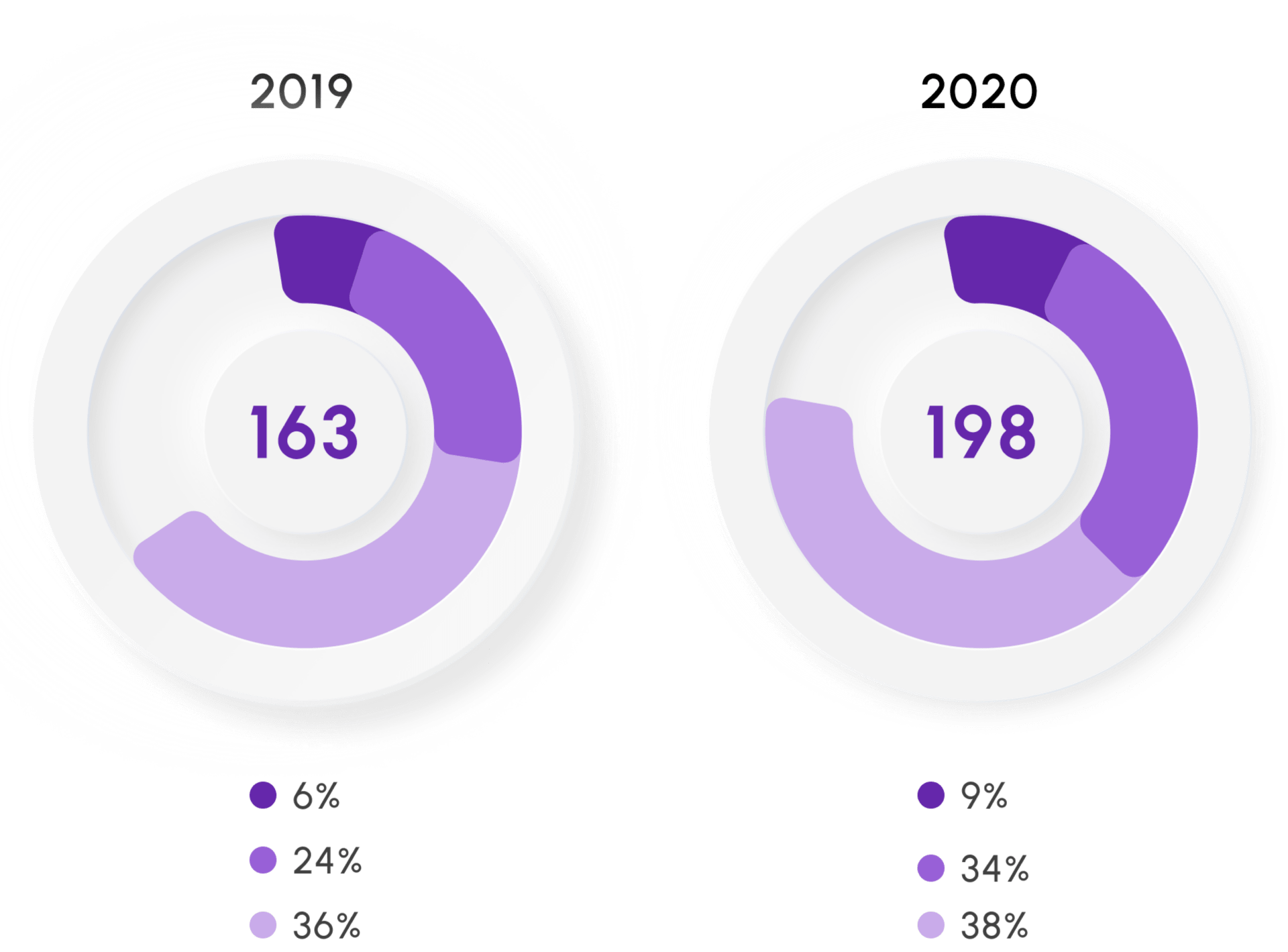

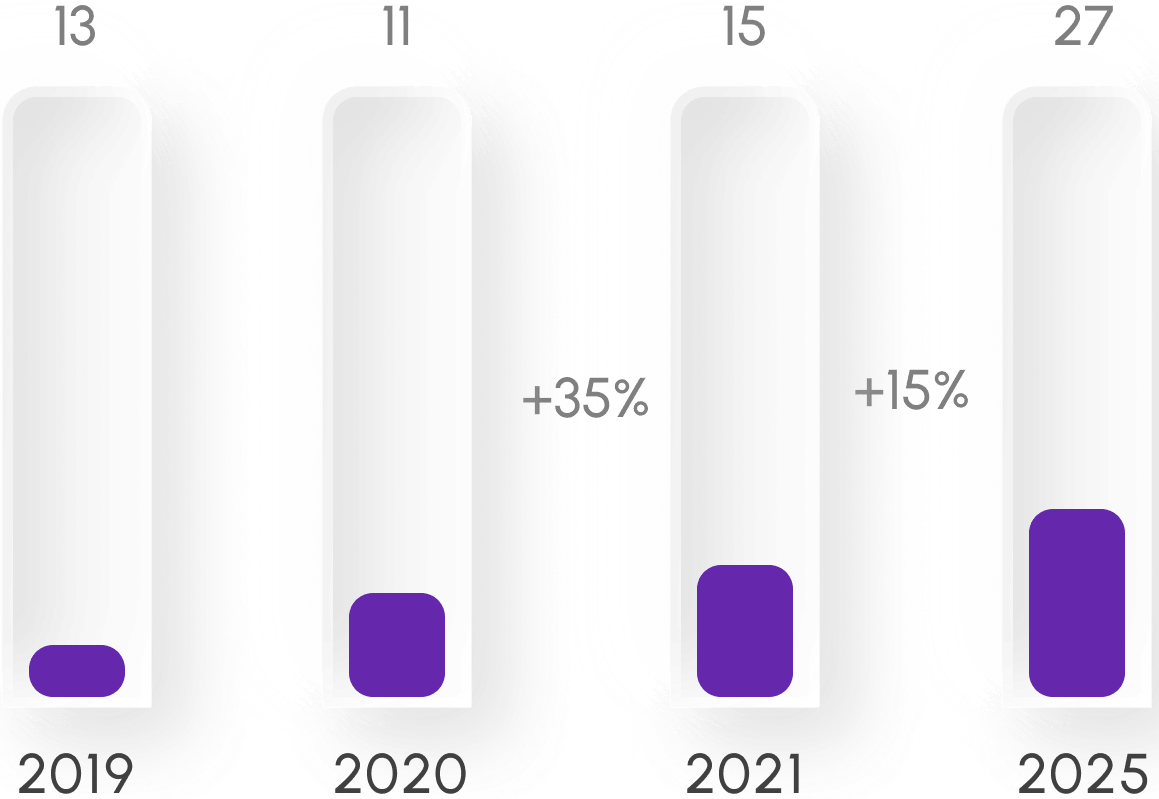

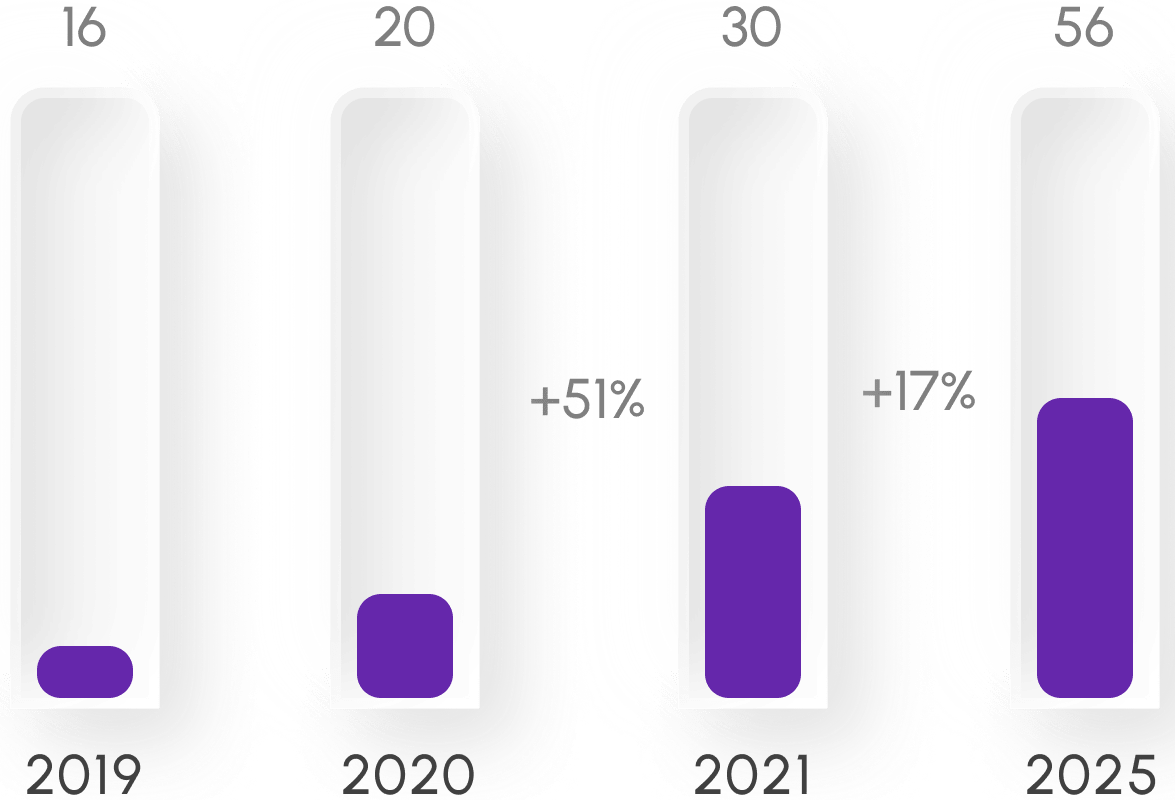

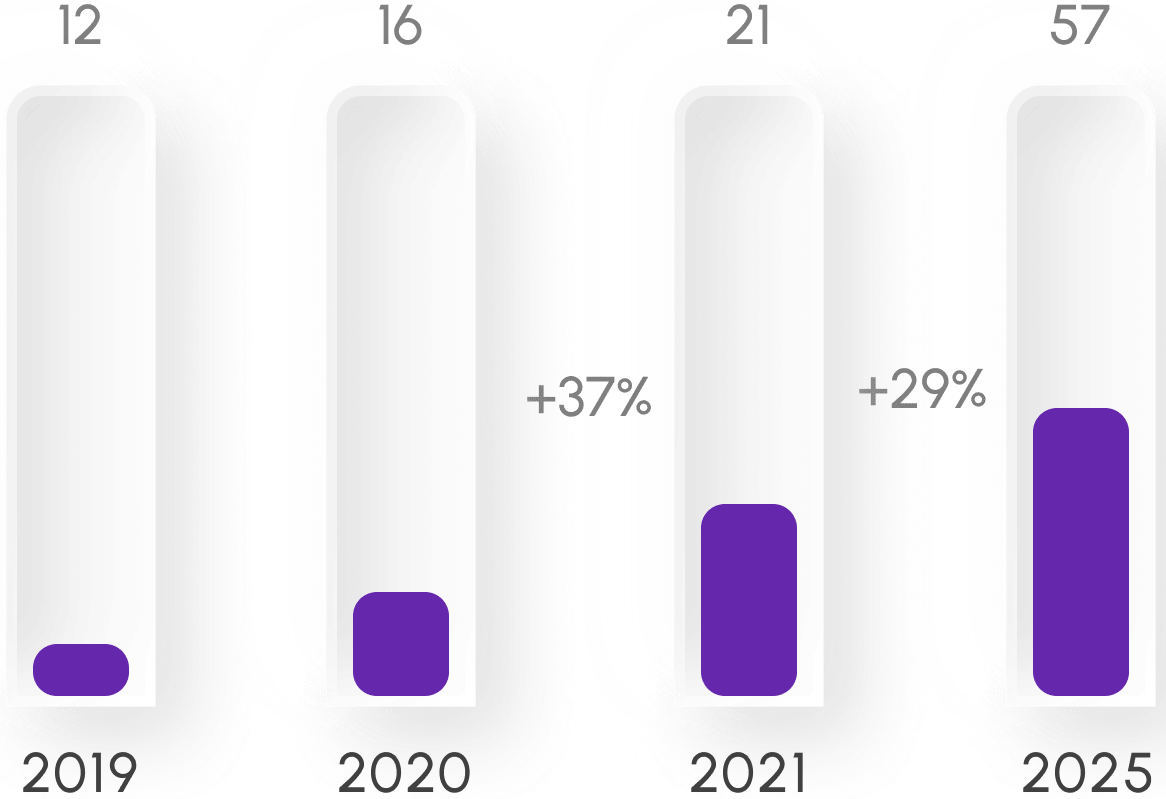

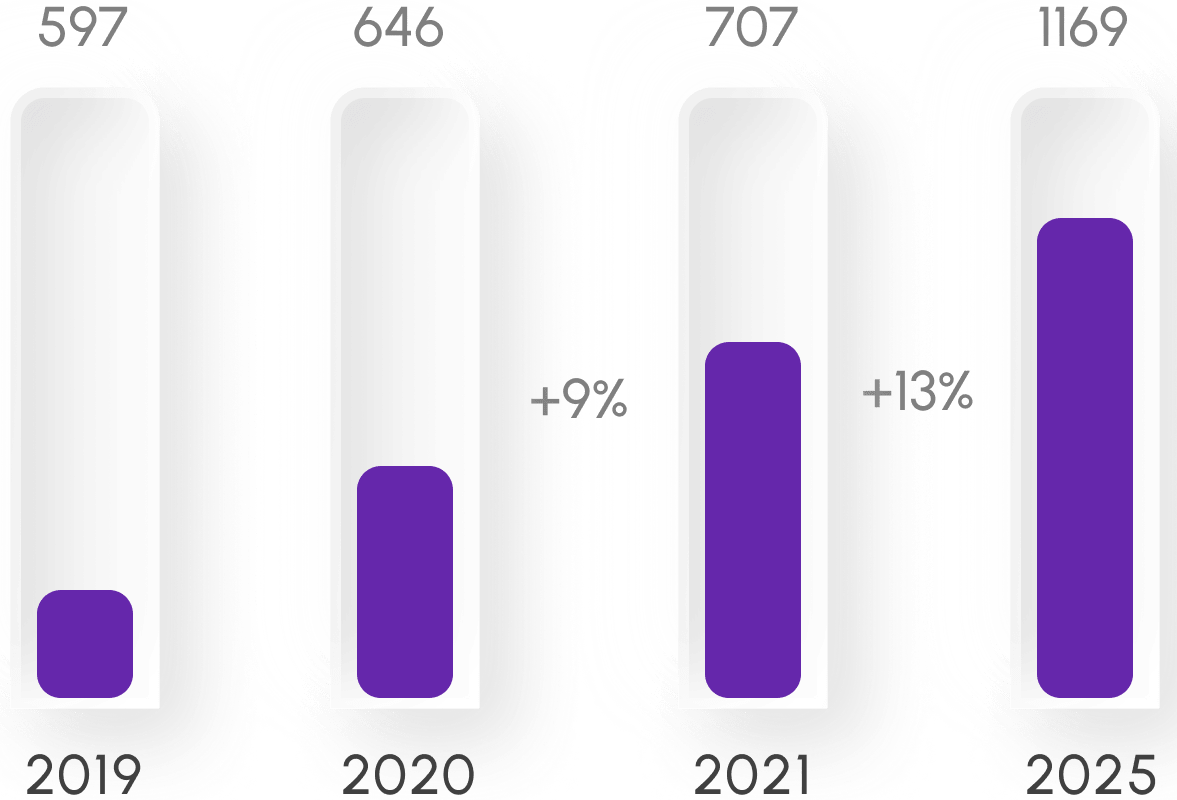

Digital financial services GMV growth has been accelerated during COVID

All digital financial services are flourishing especially digital lending

Remittance flow

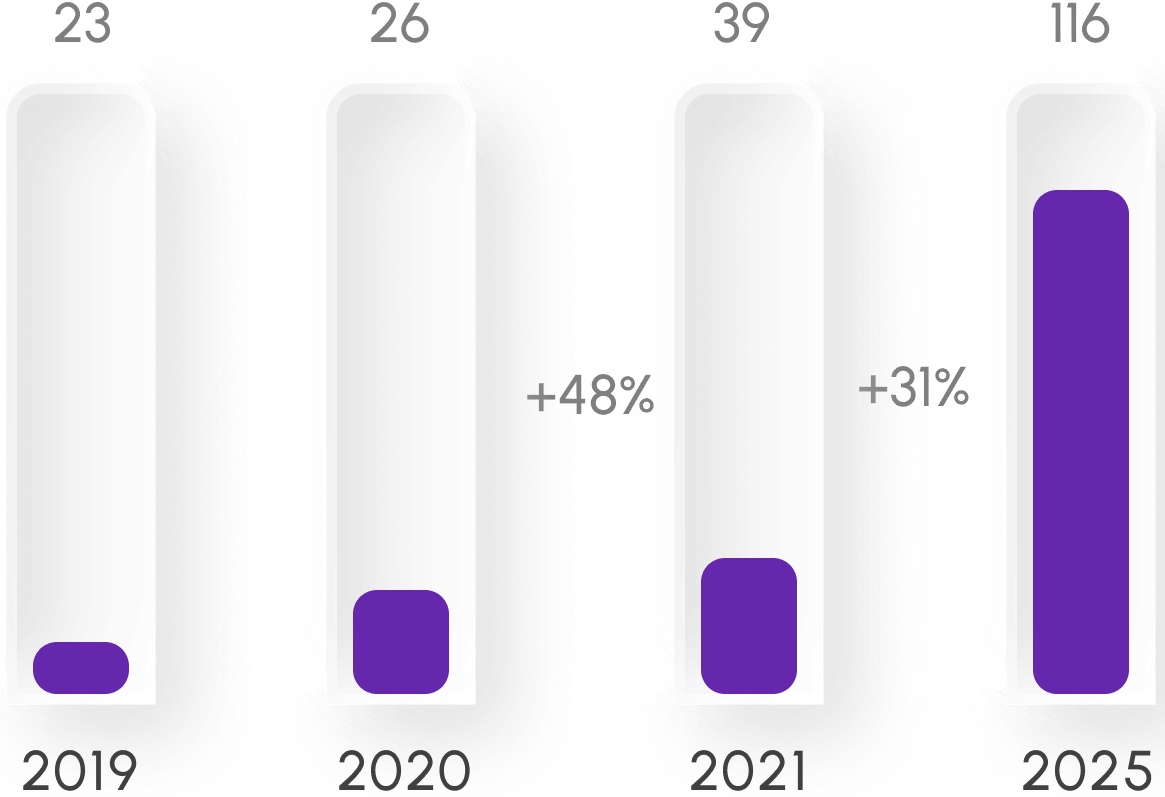

Lending Loan Book

Digital payment (GTV)

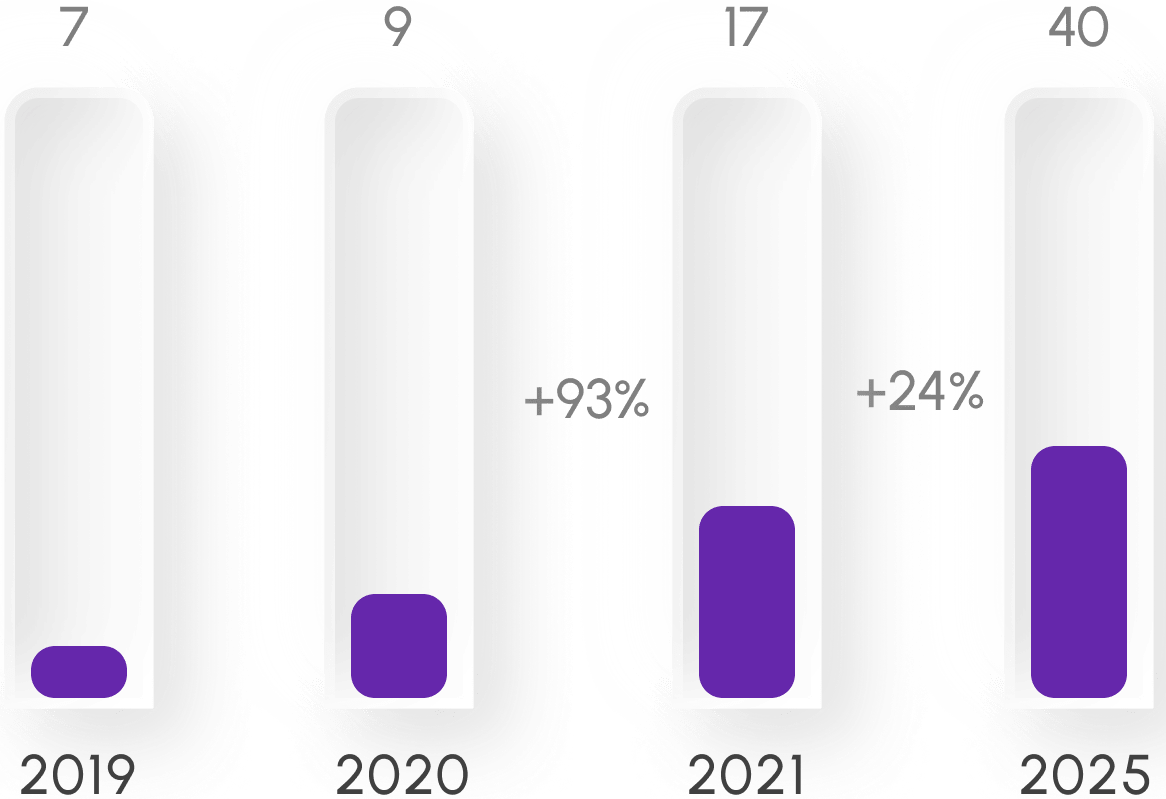

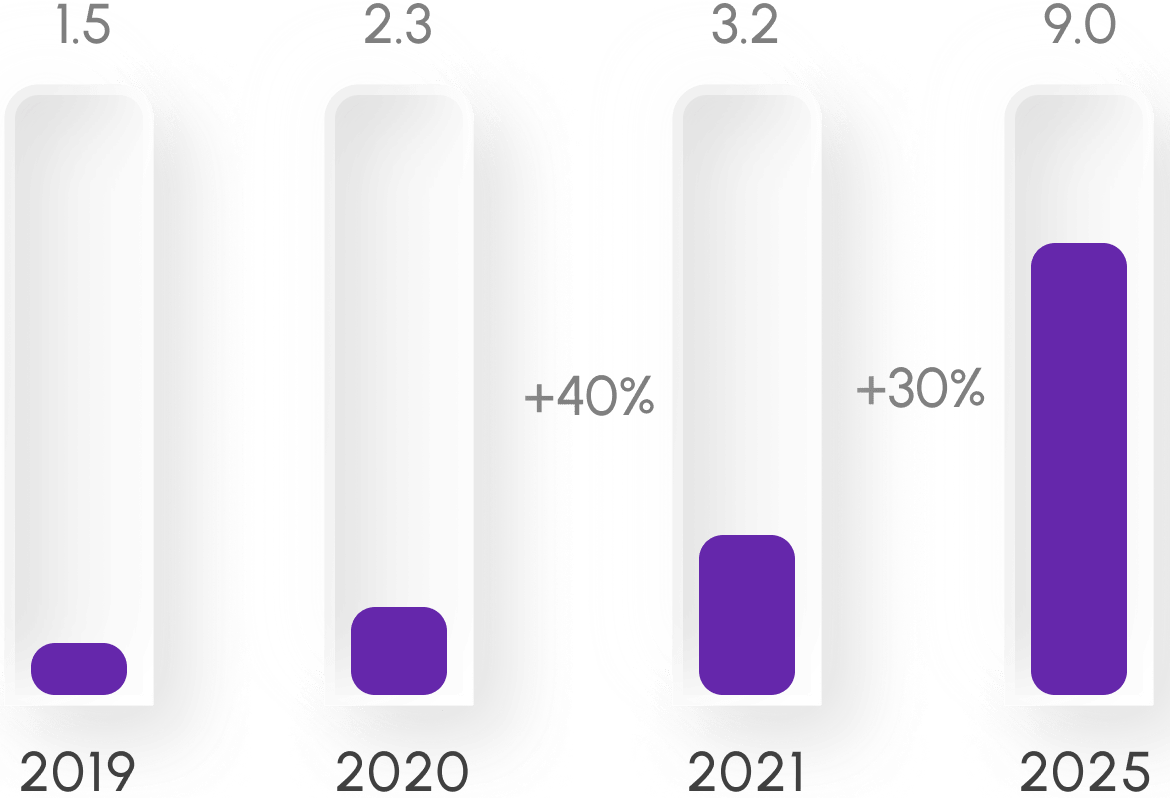

Insurance (APE/GWP)

Investment (AUM)

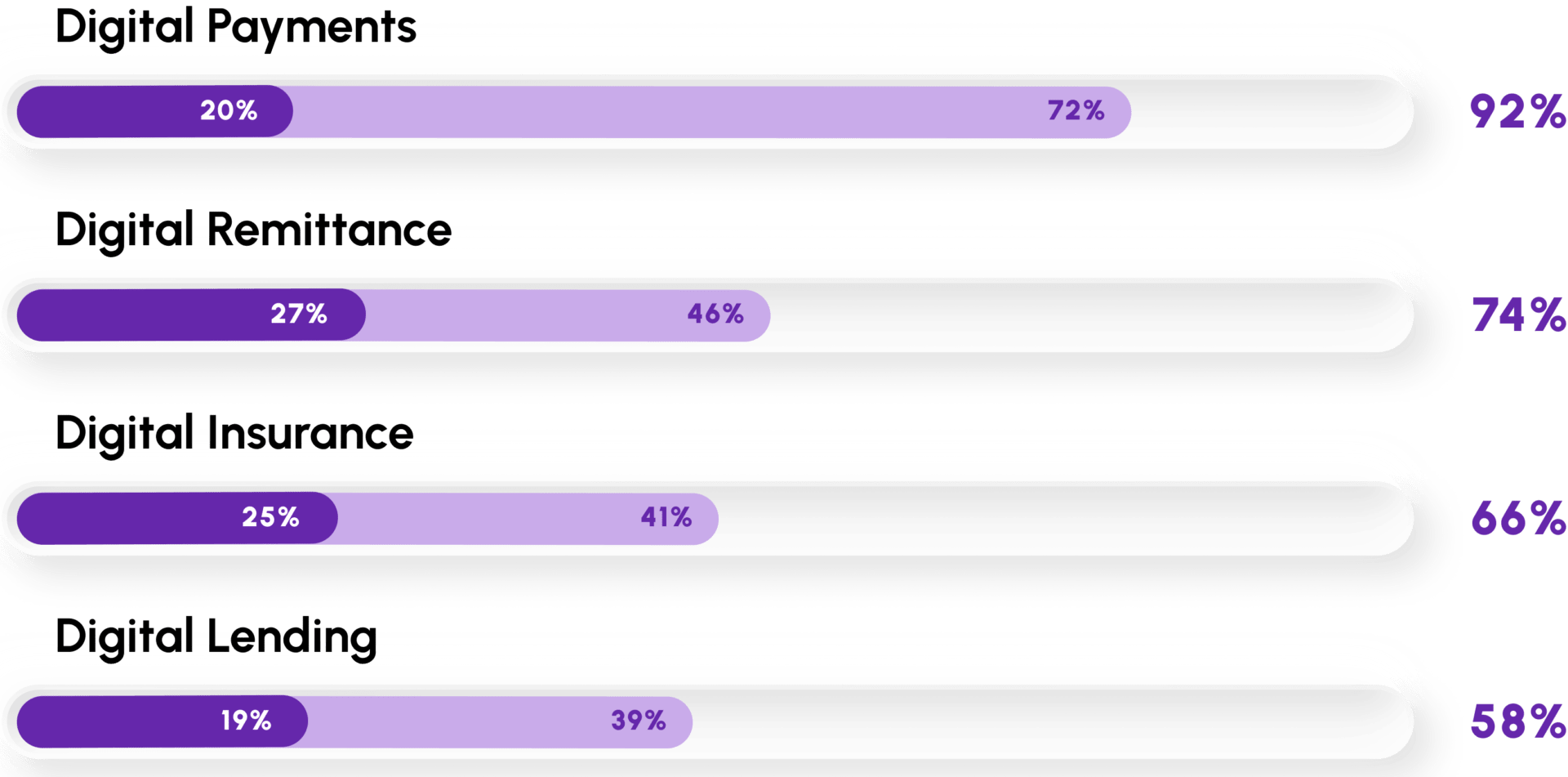

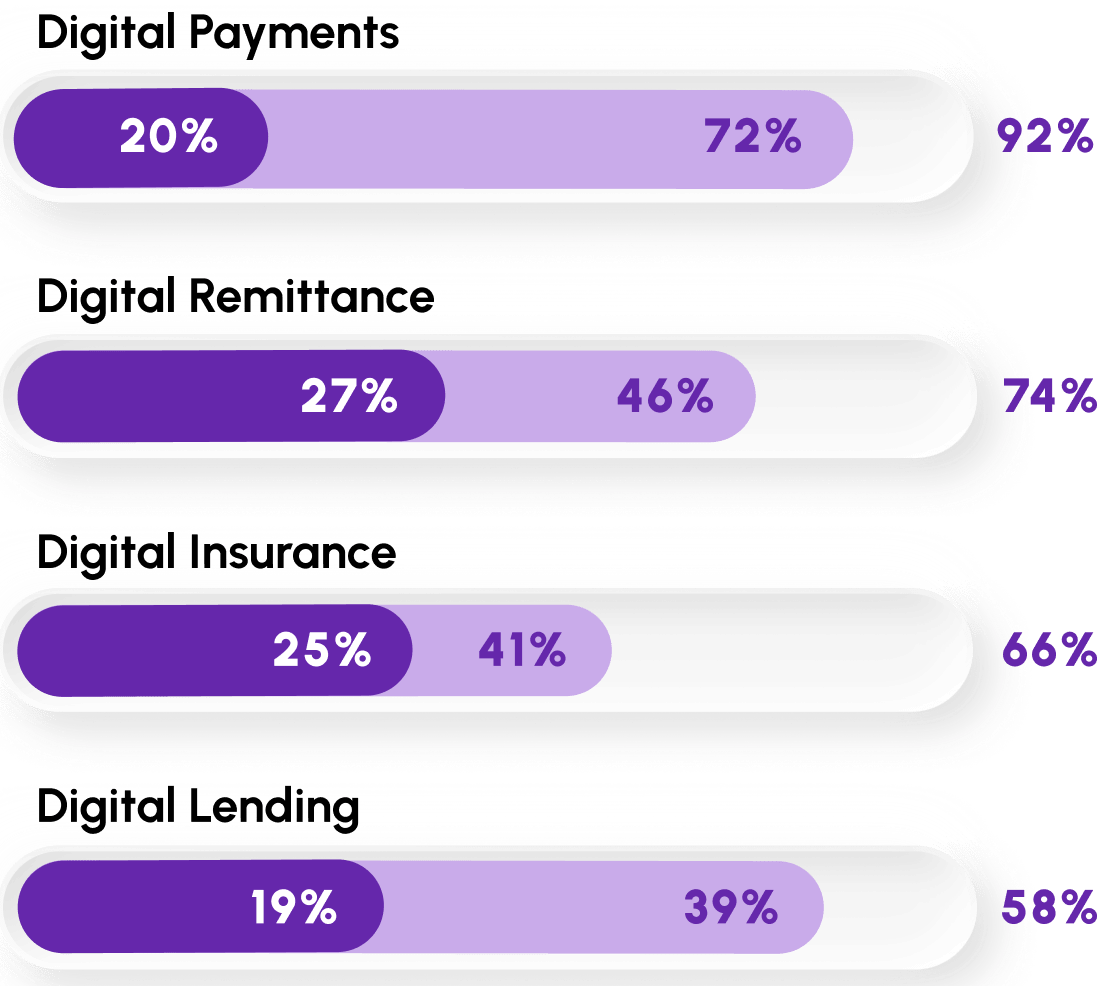

Large % of merchants likely to continue using digital financial services

Majority of merchants who use digital financial services intend to continue or increase usage

% of digital merchants likely to increase or maintain usage of digital financial services in the next 1 - 2 years

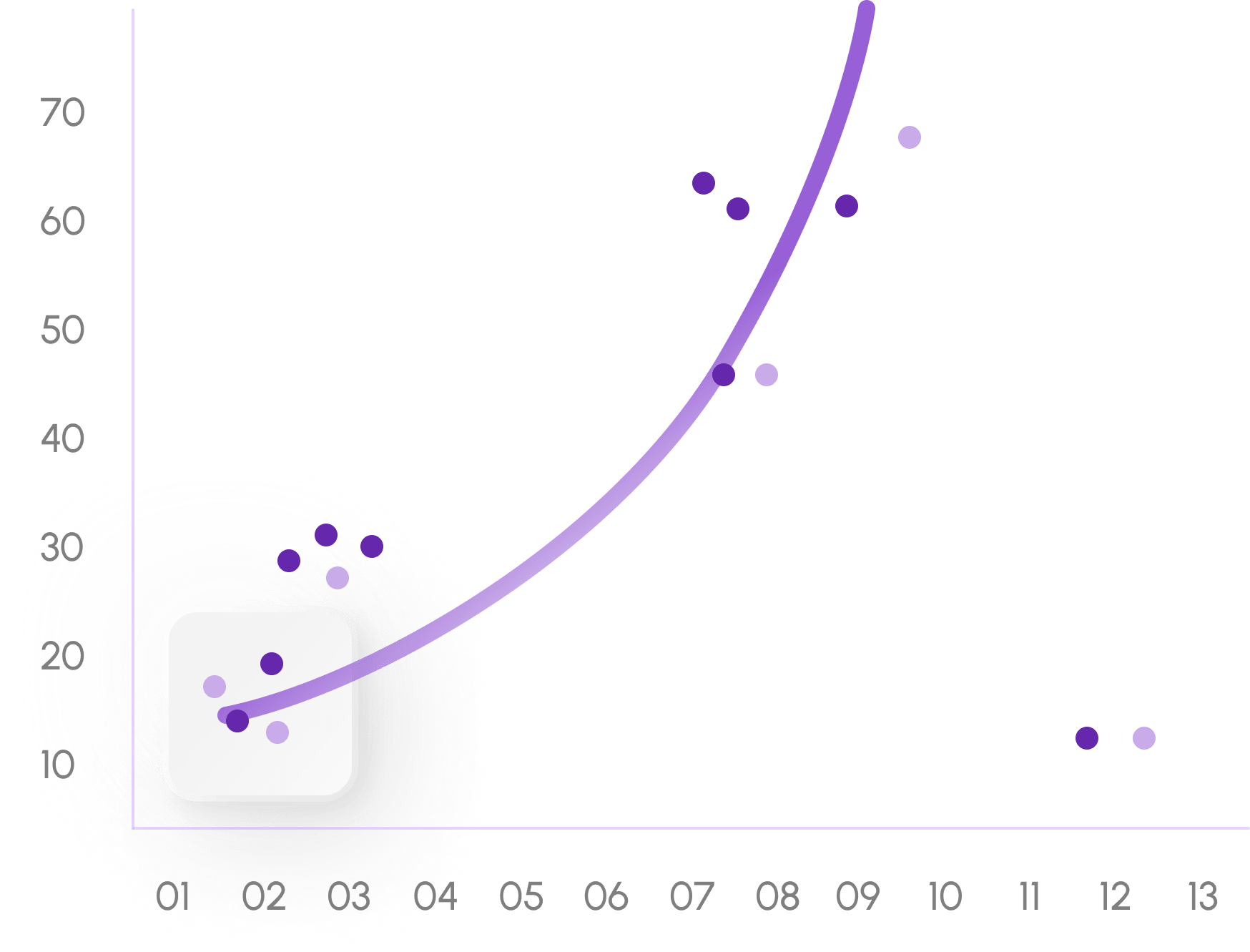

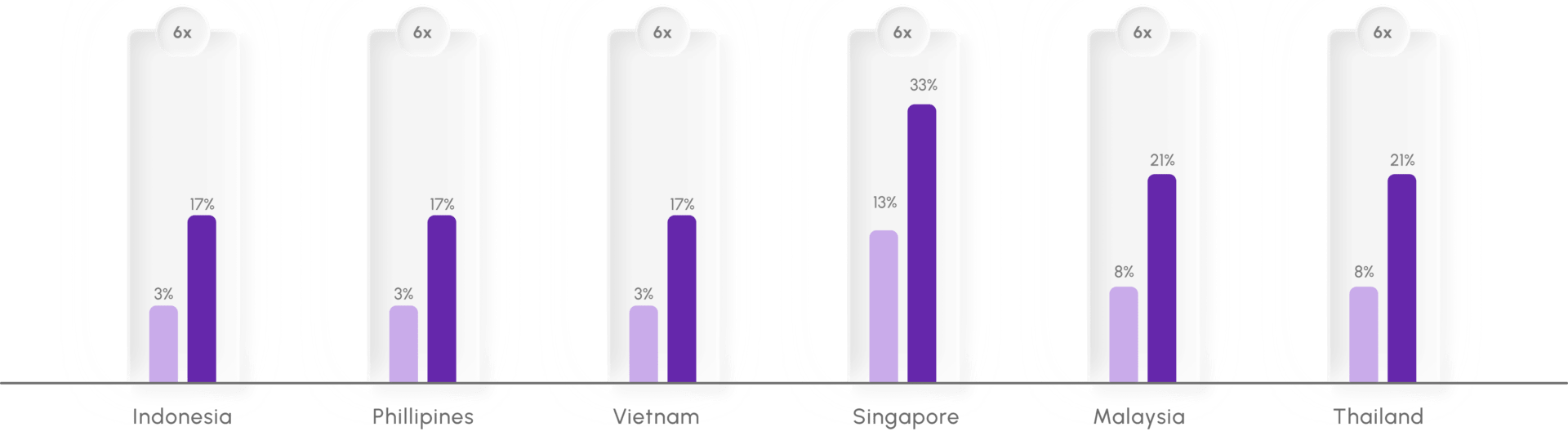

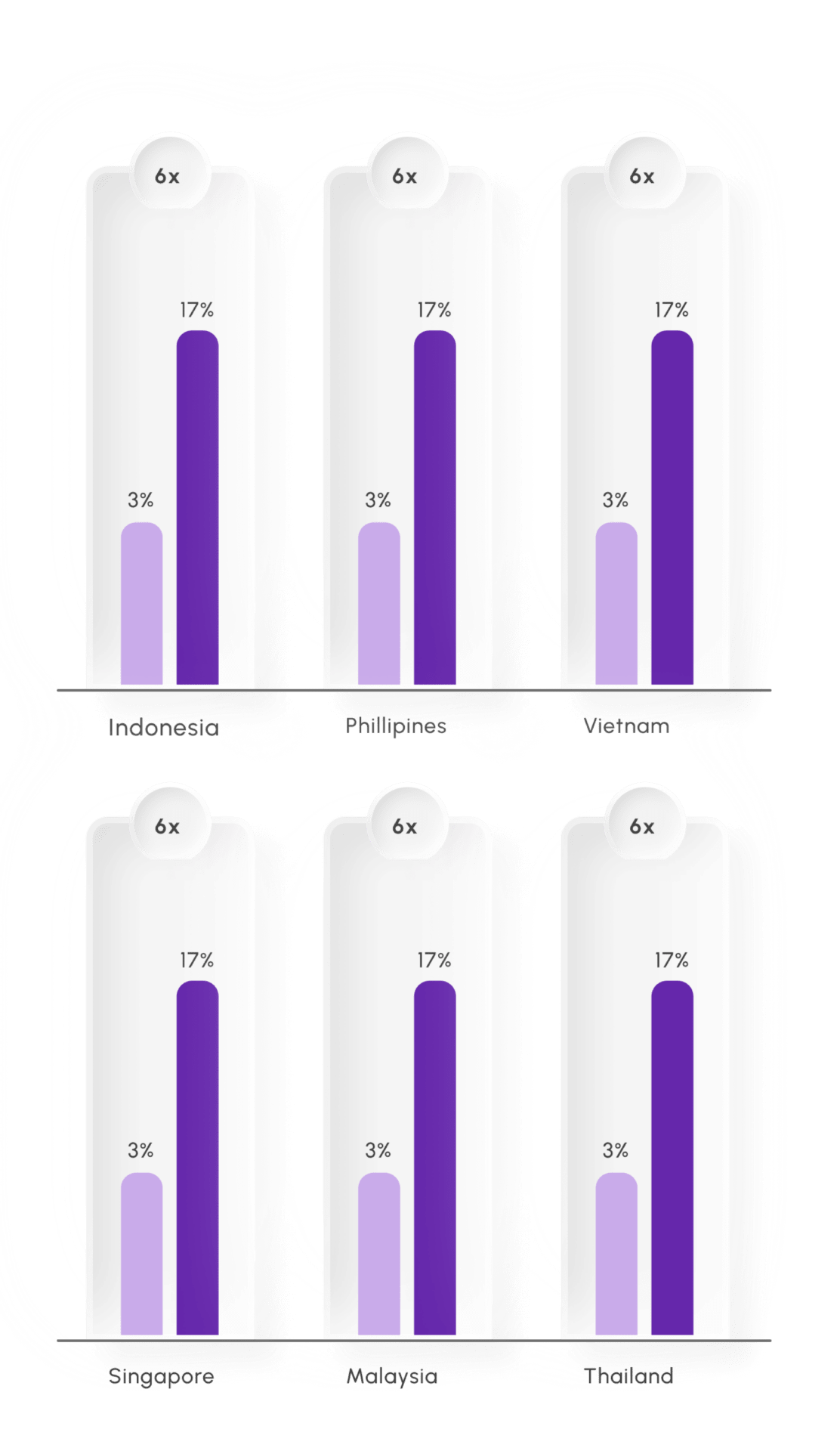

Insurance purchases have increasingly moved online with traditional channels getting distrupted

Digital Insurance is picking up pace

Like other sectors, general insurance has benefited from the digital push, with more consumers wiling to transact online and becoming less reliant on face-to-face interactions, growth will likely further acelerate as the travel sector recovers and super-apps continue making advancements in this space

Continuous innovation in insurance products

Against the backdrop of the financial inclusion agenda, micro insurance products have taken steps to build safety nets for underserved populations at affordable prices, innovative products such as fractionalisation of insurance premiums paid by per-ride incentives have been developed specifically for digital platform use cases

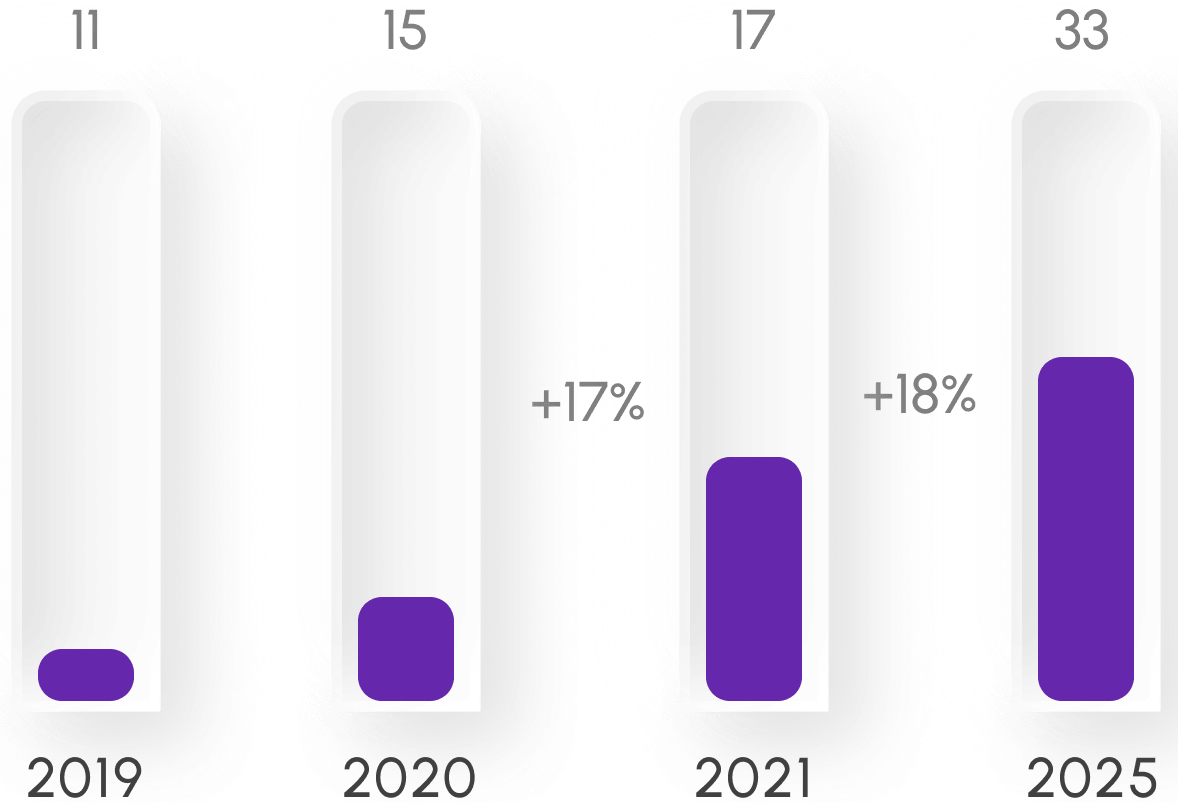

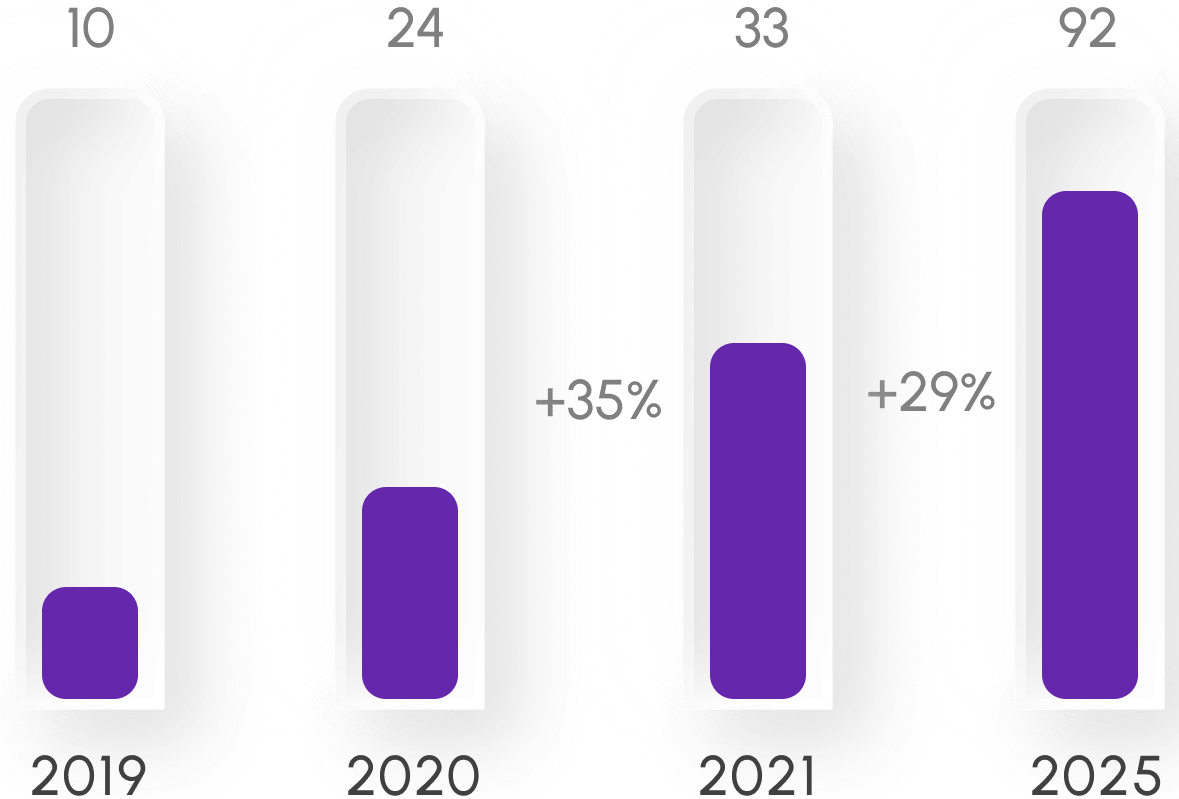

Digital Insurance (APE/GWP,$B)